Back at camp G31000 we have another provocative debate raging on with "can we say that risk management helps to predict the future?" [ LINK ] ... Let's ruminate on this statement for a moment.

Prediction and forecasting are a long standing deliberation but one that many people from the risk profession will ponder on at some point in their careers and it all ends up being partly philosophical but definitely paradoxical as we shall see.

Surely the more accurate we are in predicting something, the better off we become? ...

Prediction and forecasting are a long standing deliberation but one that many people from the risk profession will ponder on at some point in their careers and it all ends up being partly philosophical but definitely paradoxical as we shall see.

Surely the more accurate we are in predicting something, the better off we become? ...

If only you could predict

Just fantasize for a moment that we could predict or foretell the future with complete accuracy, anything and everything; the price of gold tomorrow, whether it is going to rain next Wednesday, when our own demise is due, anything and everything; would we be better off?

Well for one thing, the enjoyment to be had from any kind of competitive sport would be lost! Why would there be a purpose for contest when the spectators know the outcome but away from Cricket, with perfect knowledge you would also be able to apperceive the exact supply and demand for any commodity. The amount of rice eaten and wasted, everything would be instantly obtainable and immediately, why? ... When something is known, supply chain inefficiencies can be negated.

As an outcome of perfect knowledge the value in everything drops to zero, not because it exists or does not in this binary enchantment but because the stakeholder has awareness of the fact. At this very moment two critical axioms of our universe need to come into play, they are:

Axiom-II Constrains our predictive abilities and foretelling the future will eventually elude us ~ accurate prediction will always have its limits sitting below the end goal.

Well for one thing, the enjoyment to be had from any kind of competitive sport would be lost! Why would there be a purpose for contest when the spectators know the outcome but away from Cricket, with perfect knowledge you would also be able to apperceive the exact supply and demand for any commodity. The amount of rice eaten and wasted, everything would be instantly obtainable and immediately, why? ... When something is known, supply chain inefficiencies can be negated.

As an outcome of perfect knowledge the value in everything drops to zero, not because it exists or does not in this binary enchantment but because the stakeholder has awareness of the fact. At this very moment two critical axioms of our universe need to come into play, they are:

[Axiom I] Risk or the downside of uncertainty may be repelled by those who suffer from it but it becomes consequently valuable when it is managed. More uncertainty translates to greater unknowing and that makes something risky, unlikely and rare. Rare things happen to be precious and so risk ends up being valuable or expensive, depending on whether you suffer from it or you are underwriting it of course.

[Axiom II] The next axiom ensures that it will always be impossible to predict the future. Someone with skin in the game but also with perfect knowledge of their systemic province will attempt to alter or transfer away what displeases them and when they do, they introduce new factors of randomness into their system.

For example; Say you knew without any uncertainty the nature and time of your own demise, you may try to avoid this event but your new actions will inevitably change the future and modify your original prediction as an outcome.Axiom-I From a speculators perspective, the value of risk increases when uncertainty does ~ risk is valuable.

Axiom-II Constrains our predictive abilities and foretelling the future will eventually elude us ~ accurate prediction will always have its limits sitting below the end goal.

Types of randomness

So it appears that we can't predict risk then and that we shouldn't put our lives on the line when it comes to anything from the world of uncertainty, yet we do; we fly in airplanes that operate in complex environments immersed in randomness, we live in an economy where every price is floating and randomly, and whether we like it or not, we can't really escape uncertainty.

Uncertainty itself is not a single thing but a universe of alternate considerations and it comes in many different forms. The taxonomy delineations that Donald Rumsfeld slots randomness into are quite fascinating, very useful and his noteworthy statement from 2002 of "We have known knowns, known unknowns and unknown unknowns" is celebrated by risk analysts the world over.

Different types of randomness that originate from two different worlds, the first domain is a prevalent system where maximum likelihood estimators can be calculated and will assist us in dimensioning a range of potential future outcomes. There are also novel systems which may be highly impacting but are generally very difficult to anticipate because they furnish us with few data signals on how they behave. Acquiring prevailing knowledge about novel uncertainty requires the deployment of very divergent risk management technology and is perhaps one of the most important areas of risk management needing attention today.

If we can forecast the outcome of uncertainty or just understand it, then we might be able to operate better with it, we might even be able to benefit from it. That is the single most useful value-proposition of risk management.

Martin Davies | Causal CapitalForecasting risk allows us to apprehend it but never predict it, there is a difference. What is important is that by comprehending how a system functions we can plan for what randomness may serve up for us.

Types of randomness | Causal Capital [click to enlarge]

Uncertainty itself is not a single thing but a universe of alternate considerations and it comes in many different forms. The taxonomy delineations that Donald Rumsfeld slots randomness into are quite fascinating, very useful and his noteworthy statement from 2002 of "We have known knowns, known unknowns and unknown unknowns" is celebrated by risk analysts the world over.

Different types of randomness that originate from two different worlds, the first domain is a prevalent system where maximum likelihood estimators can be calculated and will assist us in dimensioning a range of potential future outcomes. There are also novel systems which may be highly impacting but are generally very difficult to anticipate because they furnish us with few data signals on how they behave. Acquiring prevailing knowledge about novel uncertainty requires the deployment of very divergent risk management technology and is perhaps one of the most important areas of risk management needing attention today.

Risk Forecasting Models

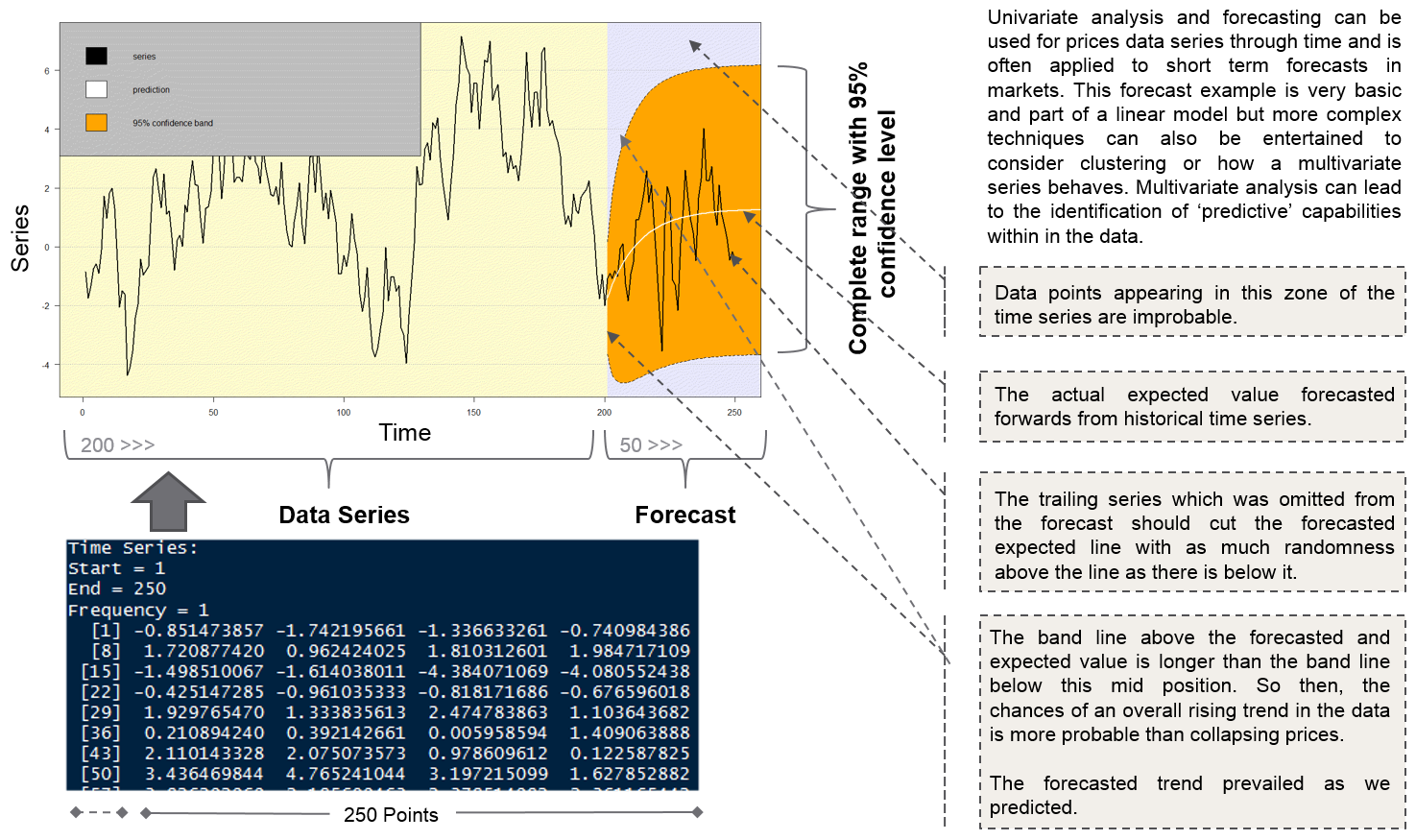

So then, we can forecast in a prevalent system and it is quite easy to do so because the techniques for achieving such measures are relatively mature, well tested and available to everyone in a wide array of formats. In the example below we have taken a random univariate time series and carried out such a forecast and I did this just to prove that forecasting is possible.

One quagmire we must avoid is believing that this forecast above is an absolute prediction when it is not!

Oh yes, a prediction has been supplied (see the white line on the graph) but we have to accept the differences between a range bound forecast and an absolute prediction. An open forecast is a description of randomness while an absolute prediction is a hope on what we expect uncertainty will turn out for us.

So we have our expected prediction, our white line on the graph but to be confident on what is forecasted, we also have the deep yellow band.

Is there value in what we have quantified above?

Absolutely! ... We can now say with confidence what randomness is likely to deliver to us and if you don't feel confident with the forecast, you can always increase the confidence level.

If our risk appetite is low, we should have high confidence levels around the 99.98% end of the spectrum and the reverse applies. Nevertheless, we must always accept that as the confidence level increases, so does the spread of the forecast or our deep yellow band in this case, expect it to widen.

Now the forecast that we have performed here is fundamentally simple, it accounts for volatility, shape and estimated likelihood within the data but it could also be extended in many ways.

Many risk analysts will attempt to increase the complexity of the functional algorithm under this forecast and they do this to capture more shape predictors within their observed data. However, often the best results can be achieved by improving the quality of data that has been captured and on this note I will finish with; one of the biggest types of randomness we need to accept doesn't originate from the volatility within a data but the quality of the data we observe and this is nearly always impacted by the way we frame it, Axiom II nearly always holds true.

R-Project Fitting Example Explained | Causal Capital [click to enlarge]

Oh yes, a prediction has been supplied (see the white line on the graph) but we have to accept the differences between a range bound forecast and an absolute prediction. An open forecast is a description of randomness while an absolute prediction is a hope on what we expect uncertainty will turn out for us.

So we have our expected prediction, our white line on the graph but to be confident on what is forecasted, we also have the deep yellow band.

Is there value in what we have quantified above?

Absolutely! ... We can now say with confidence what randomness is likely to deliver to us and if you don't feel confident with the forecast, you can always increase the confidence level.

If our risk appetite is low, we should have high confidence levels around the 99.98% end of the spectrum and the reverse applies. Nevertheless, we must always accept that as the confidence level increases, so does the spread of the forecast or our deep yellow band in this case, expect it to widen.

R-Project Code For Forecast | Causal Capital [click to enlarge]

Many risk analysts will attempt to increase the complexity of the functional algorithm under this forecast and they do this to capture more shape predictors within their observed data. However, often the best results can be achieved by improving the quality of data that has been captured and on this note I will finish with; one of the biggest types of randomness we need to accept doesn't originate from the volatility within a data but the quality of the data we observe and this is nearly always impacted by the way we frame it, Axiom II nearly always holds true.

Enterprise Architecture Manager is a Risk Modeling robust repository that organizes, integrates and analyzes information about an organization's architecture elements.

ReplyDelete